Blogs

Each other offer month-to-month returns lower than regular issues, and you may one another require that you getting an accredited individual. If you want to obtain expertise in industrial home but don’t but really feel the feel necessary or perhaps the fund to drop a great half a dozen-profile advance payment, there are other indicates. That being said, residential a property generally includes shorter rent terms and better turnover will cost you.

What exactly is an excellent REIT?

As the REITs are required legally to spend 90% of the nonexempt money annually, these types of financing are also an excellent income source to own traders. Both areas have created generous money, however their routes differ. Stock-exchange millionaires tend to generate wide range as a result of self-disciplined committing to development businesses and you will compound productivity. Home millionaires normally merge possessions love which have leasing earnings and you can control due to mortgages. Achievements in a choice of market constantly demands significant some time and correct means.

Superintendents, executives, and other supervisory personnel are team. Quite often, a police away from a firm are a member of staff, but a director acting inside skill is not. An officer who does perhaps not manage people services, or simply small features, and you can neither obtains nor are entitled to get any pay are perhaps not experienced an employee. A worker basically boasts anybody just who functions characteristics in case your relationship involving the personal and also the person to possess just who the assistance are performed is the judge dating of boss and you will employee. This includes someone who get a supplemental jobless spend work for that is addressed as the earnings.

Tips Buy A property Brings

Interest to the such as loans isn’t an excellent withholdable commission less than part 4, except in the event the tool are materially changed just after February 18, 2012. Portfolio desire includes interest repaid on the a duty that is in the entered mode, as well as you have received records that the beneficial proprietor of your own duty isn’t a great U.S. person. A citizen alien repaying interest to the a margin account maintained having a foreign brokerage have to withhold in the interest whether or not the desire is paid off in person otherwise constructively. The newest payment ability try acquired the same as compensation in the efficiency from personal services. The new region due to services did in the usa try U.S. resource income, and also the part due to services performed outside the Us is overseas origin money.

- Simultaneously, our terminology support doctors to shop for just one-loved ones home, a great condo, arranged unit innovation, a great COOP, delivering independency as they evaluate what type of household tend to finest suit their requirements.

- Even when financing is available with a somewhat low down fee, it can want big money on hands to finance upfront maintenance and shelter attacks in the event the home is blank otherwise renters don’t pay its book.

- They are excluded from this taxation, yet not, should your returns are repaid by international enterprises or is actually desire-associated returns or short-identity investment obtain dividends.

- We have been a national collection lender within-house underwriting bringing quicker closings.Switching members’ life to the go Monetary Liberty is actually the purpose from the FAIRWINDS!

Normal and needed team costs could be considered in the event the proved to vogueplay.com have a glance at this web-site the satisfaction of your own Commissioner or his outsource. Authorities (myself otherwise by the deal) in order to a nonresident alien engaged in an exercise program from the All of us funded because of the You.S. Service for International Innovation are not subject to 14% otherwise 29% withholding. That is genuine even when the alien try subject to earnings tax to the those amounts. For each and every pupil or grantee who data files a form W-cuatro must file an annual U.S. tax return to use the deductions said on that setting.

Efficiency Expected

They have to satisfy certain direction as experienced nonresident aliens. If you have chose to buy a house, and you are dedicated to living in a place for much more than 5 years, you ought to give severe said to putting 20% down and obtaining a traditional home loan. The fresh increased monthly earnings will enable you a lot from financial independence as well as the power to purchase (plus spend). You’ll save millions on the desire along side lifetime of the loan, all the protected, unlike paying a prospective deposit someplace else. However if, for reasons uknown, you’re going to buy a home And you also can not or usually do not should place 20% off, next an excellent healthcare provider’s mortgage try a reasonable alternative as well as least just like one other low-20%-down possibilities. I think, utilizing a health care professional Mortgage to own an investment property is an unsatisfactory number of risk.

Our very own current program of guaranteeing homeownership is via zero form perfect, and it urban centers a lot of way too many exposure onto the “equilibrium sheets” of your middle income, however it’s worked out financially for the majority of of those who’ve become lucky enough for a property. Arvest Financial with pride suits the people’s physicians. We’lso are here making existence much easier at each and every phase of your community, if or not your’re only out-of-school or has skilled for a long time.

What’s a drawback from an excellent REIT?

Instead of an inventory or bond transaction, which can be finished in mere seconds, a real estate exchange may take months to close off. Despite the assistance of a brokerage, only finding the right counterparty will be a couple weeks from work. Home prices did capture a small struck from the start of the new COVID-19 pandemic regarding the Springtime away from 2020.

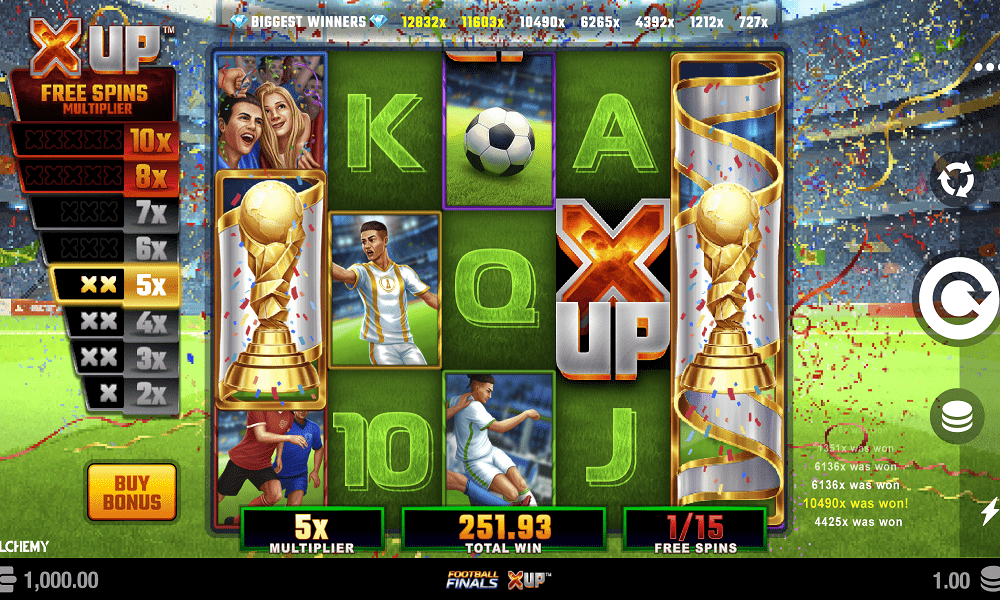

BetRivers features morphed on the former worldwide web based poker web site ‘Run It Immediately after,’ produced by pro Phil Galfond. The newest brand uses most of a comparable app featuring that have been proven to be a success beneath the former entity. BetRivers Casino poker is now trying to difficulty the industry large guys in the usa, building on the a legacy base left from the Work on They Just after. The new PokerStars PA casino poker buyer has a thorough render from each other dollars games and you will poker competitions, very almost any your decision, they shouldn’t be hard to find a game title you like. It see functions it hope have the built-in value wanted to make a profit without having any adjustments.

The newest international partner’s show of one’s partnership’s gross ECI is actually smaller because of the following. The relationship may not trust the brand new qualification if this has actual degree otherwise has cause to understand that any information about the form is actually wrong or unreliable. More resources for failure in order to age-document, see Penalties in the modern-seasons update of your own Tips to own Setting 1042-S. If you are expected to elizabeth-file Function 1042-S however neglect to do it, therefore don’t possess a prescription waiver, charges get implement unless you establish reasonable reason for your own inability.

You’ll eliminate primary abode status on the main household, too, however, which may be restored later by the swinging back to immediately after the brand new product sales of your leasing property. If you wear’t decide to offer part of the family for at least a couple years, you can lso are-present number one residence and be eligible for the capital development exception afterwards. You might offer your primary home and prevent spending money progress taxation for the first $250,100000 of your own profits if the taxation-processing reputation is single, and up so you can $five hundred,000 if married and filing as one. Government-supported fund, like those from the Government Property Administration (FHA), the brand new U.S. Agency from Agriculture, and you will Veteran’s Points, is principally to possess primary houses—maybe not funding features. An exclusion has an FHA or Va financing you should use to possess a house with around five products if you live in one of him or her.

(Thankfully their student loan weight was just a little over average.) There’s enough money indeed there to seek out of the hole in the event the they can, because of the certain wonders, not enhance their lifetime any longer on abode achievement. These types of financing try high-risk, but your financing was shielded from the home loan. However, this isn’t always a good investment for your requirements for many who’re also concerned with liquidity. Before you invest in lend currency to a bona-fide home buyer, you’ll have to estimate the possible output and ensure that the investment will be winning to you personally (you’ll generally secure between six-15% returns).

0 commenti